How Upcoming Residential Projects Shape Property Investment Across Districts 18 and 23

Singapore’s housing landscape is constantly shifting, but certain areas stand out when it comes to growth, livability, and long-term returns.

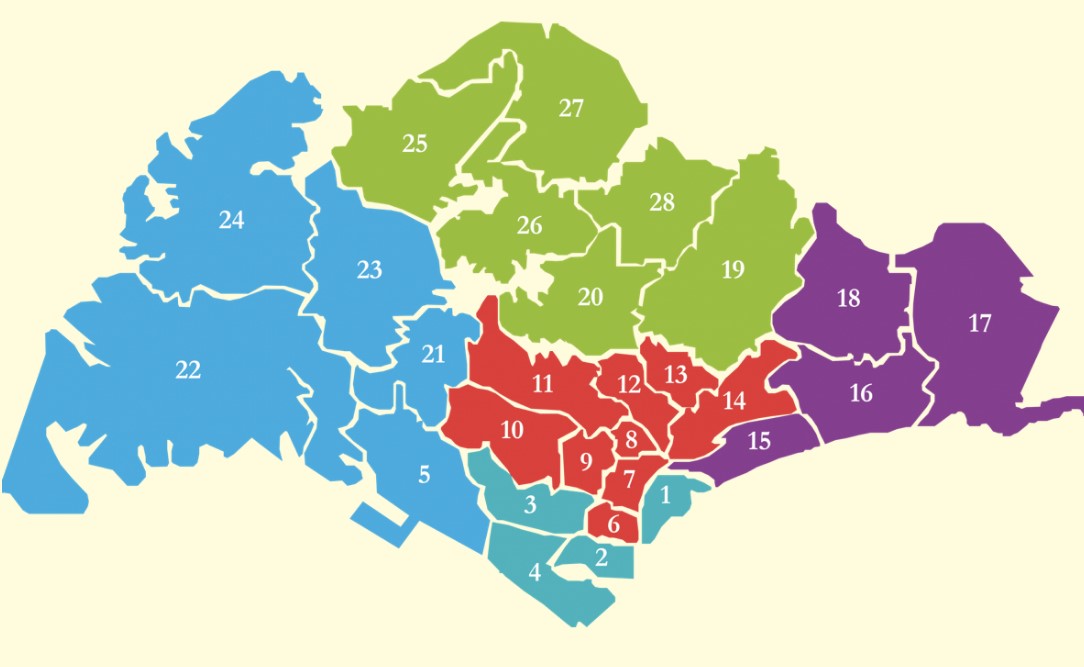

Districts 18 and 23 – covering Pasir Ris, Tampines, Simei, Bukit Batok, Hillview, and Choa Chu Kang – have become two of the most closely watched regions among property investors.

Each district brings its own blend of new launches, infrastructure improvements, and lifestyle appeal that continue to influence buyer behavior and price movements across the city-state.

Why Districts 18 and 23 Are on the Investment Radar

Both districts sit at opposite ends of Singapore geographically, but they share a similar story: steady development backed by major government planning, improved connectivity, and growing demand for suburban living.

District 18, anchored by the East Region’s established towns, appeals to families who value coastal access and a laid-back lifestyle.

For an example of how new launches drive demand in the East region, you might explore Pinery Residences.

District 23, on the other hand, attracts investors drawn to West Singapore’s evolving industrial, educational, and green corridors.

One of the standout launches worth watching is Narra Residences, which highlights the momentum in District 23.

Let’s break down what’s fueling property interest in both.

- District 18 (Pasir Ris, Tampines, Simei): Mature estates, major transport upgrades, and strong rental demand from Changi-area workers.

- District 23 (Bukit Batok, Hillview, Choa Chu Kang): Expansion of the Jurong Lake District, better connectivity via new MRT lines, and affordable entry points for new investors.

The upcoming residential launches in both districts are reshaping not just their skylines but also how investors evaluate long-term potential in suburban areas.

District 18: The East’s Steady Performer

District 18 has always been a dependable region for investors looking for stable appreciation and high livability.

With major hubs like Tampines Regional Centre, Jewel Changi Airport, and Eastpoint Mall within easy reach, the area provides a balanced mix of work, retail, and leisure.

Infrastructure and Transport Growth

The Downtown Line extension and the future Cross Island Line are major catalysts for property values.

Once the Cross Island Line connects Pasir Ris to key parts of Singapore, travel times to the Central Business District and Jurong will shorten dramatically. That improvement in accessibility often translates into higher resale and rental premiums.

Another upcoming feature in Pasir Ris is the integrated transport hub, combining bus interchange, retail, and residential components in one location. Such developments often anchor local real estate prices because they create a natural demand magnet.

Upcoming Projects Worth Watching

District 18 has seen a wave of launches in recent years, many of which are built around the concept of integrated or lifestyle living.

Investors have been drawn to projects that emphasize both connectivity and family-oriented amenities.

| Project Name | Location | Key Features | Target Buyer Profile |

| Pasir Ris 8 | Pasir Ris Central | Integrated hub, retail link to MRT | Families, upgraders |

| The Tapestry | Tampines Ave 10 | Smart home features, large pool deck | Young professionals |

| Treasure at Tampines | Tampines St 11 | Mega development with resort-style living | Mass-market investors |

These projects have set a tone for how future developments in the East will evolve – less about sheer density, more about lifestyle ecosystems that cater to multi-generational living.

Why Investors Still Favor the East

Even with newer regions emerging elsewhere, the East continues to hold its ground. Its proximity to Changi Business Park and the airport drives consistent rental demand, particularly from professionals in logistics, tech, and aviation.

The schools and medical facilities around Tampines add another layer of appeal for families seeking long-term homes rather than short-term speculative buys.

Another underrated factor is the overall community planning. Tampines and Pasir Ris have well-spaced amenities, green corridors, and recreational parks that balance city life with nature – a trait that’s becoming more valuable in a post-pandemic property landscape.

District 23: The West’s Next Big Growth Corridor

While District 18 has maturity and track record, District 23 stands out as an area in transition. What used to be a quieter, suburban stretch is now being redefined by massive government projects and private sector activity linked to the Jurong Lake District and Tengah New Town.

Investors who entered the market early in Bukit Batok or Choa Chu Kang have already seen how policy-driven development can lift prices across adjacent estates.

New Connectivity and Transport Links

The Jurong Region Line (JRL) is the district’s single most significant upgrade. Once fully operational, it will connect residents directly to Nanyang Technological University (NTU), Jurong Industrial Estate, and the upcoming Jurong Innovation District.

Such accessibility improvements typically trigger price adjustments even before completion, as seen in previous MRT corridor studies across Singapore.

Bukit Batok and Hillview are also benefiting from enhanced road networks and proximity to the Downtown Line. Residents enjoy faster commutes while still living in areas surrounded by greenery, which makes the West an increasingly attractive residential choice.

Upcoming Developments Reshaping the Market

District 23’s future is being written through a series of strategic residential launches that mix affordability with long-term capital growth.

Several mid-sized projects are filling the gap between mass-market condos and premium urban developments.

| Project Name | Location | Key Features | Target Buyer Profile |

| Dairy Farm Residences | Dairy Farm Road | Mixed-use project with retail podium | Young families |

| The Botany at Dairy Farm | Petir Road | Near nature parks, family-friendly layouts | Owner-occupiers |

| Midwood | Hillview Rise | Close to MRT, city-fringe appeal | Professionals |

| Copen Grand (EC) | Tengah | Smart energy-efficient features | First-time buyers, HDB upgraders |

Each of these reflects how the western corridor is pivoting toward smart, sustainable, and lifestyle-oriented living.

Tengah, in particular, is being designed as Singapore’s first “smart and green” town, which positions nearby areas like Bukit Batok to benefit from spillover effects.

Value Proposition for Investors

Compared to mature estates in the East or Central regions, District 23 offers lower entry prices and greater potential for appreciation.

The area’s transformation is still unfolding, allowing investors to capture gains from early-stage development. Rental yields, while moderate, are supported by growing demand from nearby industrial and educational hubs.

For example, professionals working in Jurong East or students at NTU often prefer to rent near Hillview or Bukit Batok for the balance of convenience and greenery. That demand stabilizes the rental market, providing consistent returns even during slower economic cycles.

Comparing the Two Districts

While both districts offer compelling reasons to invest, their appeal depends on investor goals. District 18 provides stability and liquidity, while District 23 offers growth potential and affordability. Here’s a simplified comparison:

| Factor | District 18 (East) | District 23 (West) |

| Development Stage | Mature | Growth phase |

| Average Condo Price (psf)* | Higher (~$1,700–$2,000) | Moderate (~$1,400–$1,700) |

| Rental Demand | Strong (Changi, Tampines) | Growing (Jurong, NTU) |

| Key Catalysts | Cross Island Line, Integrated hubs | Jurong Region Line, Tengah Town |

| Investor Profile | Long-term, stability-focused | Early-stage, growth-focused |

*Figures are indicative averages based on recent transactions.

District 18 attracts those who prioritize steady returns and easy exit opportunities, given its established resale demand.

District 23, meanwhile, appeals to investors comfortable with a slightly longer holding period for potential capital appreciation.

The Role of Government Planning and Urban Redevelopment

Singapore’s master planning plays a defining role in shaping property outcomes. Both districts are embedded within the broader East and West Regional plans, which aim to decentralize the city’s economic activity and reduce commuting pressure on the downtown core.

For District 18, the ongoing rejuvenation of Pasir Ris and Tampines focuses on creating more mixed-use developments that integrate work, leisure, and living. The result is higher land value and more competitive bidding for GLS (Government Land Sales) sites.

In District 23, Tengah’s “Forest Town” blueprint and the Jurong Lake District’s transformation into a second CBD are game-changers. Investors who track URA planning maps often use such projects as signals for where long-term capital appreciation might concentrate next.

Practical Investment Considerations

When assessing opportunities in either district, investors should focus on fundamentals rather than short-term speculation.

Key Factors to Evaluate

- Connectivity: Proximity to MRT stations (current and upcoming lines) remains the top determinant of price resilience.

- Developer Reputation: Established developers tend to deliver better design, resale value, and maintenance standards.

- Tenant Base: Areas with stable employment hubs nearby (e.g., Changi Business Park or Jurong Gateway) ensure consistent rental occupancy.

- Lifestyle Infrastructure: Retail malls, schools, and healthcare facilities significantly affect both livability and resale appeal.

Balancing Portfolio Across Both Districts

Investors often allocate capital across different maturity stages of the property cycle. A balanced approach could include:

- A unit in a mature development in District 18 for steady rental returns.

- A newer launch in District 23 with long-term appreciation potential.

That mix hedges against market volatility while taking advantage of Singapore’s urban diversification.

Summary

The property markets in Districts 18 and 23 illustrate two sides of Singapore’s urban evolution: one anchored in maturity, the other in transformation.

Both are benefiting from strategic transport expansion, lifestyle-focused projects, and sustainable design principles. Investors who align their goals with the character of each district – stability in the East, growth in the West – stand to gain from a property landscape that’s more balanced, forward-looking, and resilient than ever.